Why should I read this chapter? ... because thinking about a world without money becomes real in Cambodia!

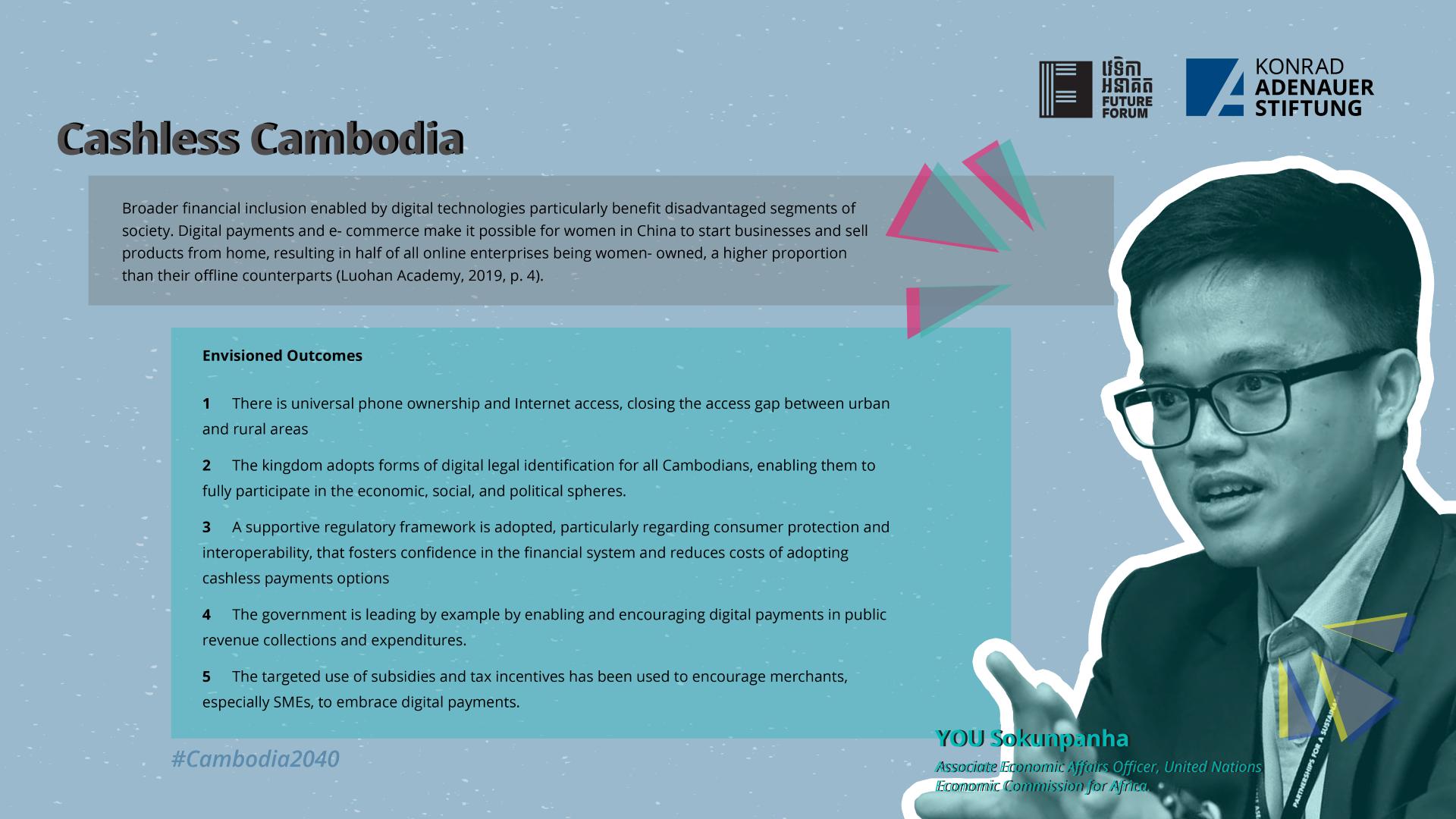

Mr. You Sokunpanha's vision of cashless Cambodia:

- There is universal phone ownership and Internet access, closing the access gap between urban and rural areas

- The kingdom adopts forms of digital legal identification for all Cambodians, enabling them to fully participate in the economic, social, and political spheres.

- A supportive regulatory framework is adopted, particularly regarding consumer protection and interoperability, that fosters confidence in the financial system and reduces costs of adopting cashless payments options.

- The government is leading by example by enabling and encouraging digital payments in public revenue collections and expenditures.

- The targeted use of subsidies and tax incentives has been used to encourage merchants, especially SMEs, to embrace digital payments.

Short story:

What is a cashless society? And how does it affect ordinary Cambodians? This is best illustrated by a day in the life of a student in 2040. She just left her hometown of Kandal to study at a university in Phnom Penh. It is the first day of the month and she wakes up to find that her early-riser parents have already transferred her monthly allowance into her bank account. Through the bank’s mobile app on her phone, she takes two minutes to make rent payment to her landlord. Before leaving the house for school, she orders a cup of coffee online from her local café and pays for it with a credit card. She picks up the drink on her way to the bus stop. When the bus arrives, she pays for the fare by scanning a QR code with her mobile wallet app. Later in the day, during a class break, she makes plans with a few classmates to see a movie during the weekend. She buys tickets on the cinema’s website and pays for them with her mobile wallet account. She then uses the app’s bill splitting function to request the money her friends owe her for the tickets. After school, as it is raining, she skips the bus and uses her phone to order a taxi. The ride is automatically paid for with the credit card linked to her ride-hailing app profile. At home in the evening, she uses a food delivery app to order dinner. When the delivery person arrives, she pays by swiping her credit card on a card reader connected to his phone. While eating dinner, she receives a text from a friend asking to borrow $50. She clicks on the request and uses her fingerprint to authorize the loan in several seconds. And just before going to bed, she arranges and pays for a cleaner to clean her house later in the week.

Read here the full academic text!

Order details

Editor

Deth Sok Udom, Bradley J. Murg, Ou Virak, Michael Renfrew

erscheinungsort

Phnom Penh

preis

free