Country Reports

Short political reports of the KAS offices abroad

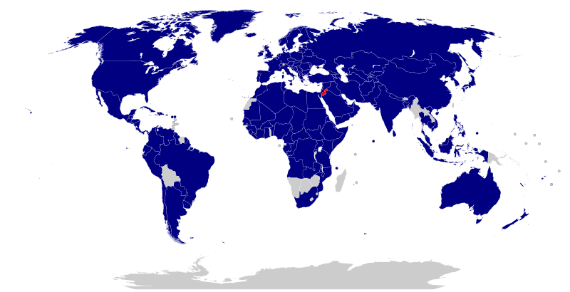

The Konrad-Adenauer-Stiftung is a political foundation. Our offices abroad are in charge of over 200 projects in more than 120 countries. The country reports offer current analyses, exclusive evaluations, background information and forecasts - provided by our international staff.

Event Reports

The Konrad-Adenauer-Stiftung, its educational institutions, centres and foreign offices, offer several thousand events on various subjects each year. We provide up to date and exclusive reports on selected conferences, events and symposia at www.kas.de. In addition to a summary of the contents, you can also find additional material such as pictures, speeches, videos or audio clips.