Issue: 2/2022

At first sight, Romania currently fares well in European statistics as one of the most energy-independent EU members. As of 2020, Romania’s imports of Russian energy sources – gas (15.5 per cent), oil (37 per cent) or coal (11.8 per cent) – were below the EU’s average; in total 17 per cent compared to overall EU dependence on Russia of 24 per cent. The country also has a relatively small energy sector compared to the rest of the Union – its total energy consumption of 25 million tonnes of oil equivalent (TOE) in 2020 is just 2.5 per cent of that of the entire EU, 11 per cent of Germany’s and less than one third of Poland’s. This means that Romania’s energy security could be quite easily ensured by coordinated EU policies for energy security, such as speeding up infrastructure interconnectivity, Commission-led joint gas import purchases, or solidarity mechanisms (reciprocal support among EU members). What is more, since Romania is the second-largest EU producer of gas, with untapped resources in the Black Sea and onshore, as well as substantial potential for renewable electricity, it could instead provide energy security to the entire region. Here, it would be an alternative supplier to countries with relatively small energy consumption such as Bulgaria, Hungary, Serbia, or Moldova (the latter being also part of the EU’s energy market).

Unfortunately, Romania has thus far had little incentive to transform the sector due to the relative energy independence, coupled with a lack of competence, poor governance, and, possibly, a subconscious reliance on the EU’s backing in the worst-case scenario. For many years, Romanian decision-makers in the energy sector have lacked a real sense of urgency for investments in key energy infrastructure, and EU funds and private funding continue to be underused for its modernisation.

Energy dependence in itself is not a major concern – consumers and countries should be fine as long as there are enough suppliers, routes, and fair commercial terms to obtain the energy required. The critical question – and the core issue of energy security in the post-February 24 world – is whether the energy supplier can use it as leverage for political gains or for abusing a dominant position. A country could become 100 per cent reliant on energy imports, and this would not be a major worry if there were many alternative suppliers operating according to fair market rules, driven by purely commercial motives and based in democratic countries, without a hidden political agenda. Nowadays, nobody in Europe has qualms about imports from other EU members, the US, or Norway. Beyond that, a country may have a relatively low share of imports for a particular energy source from Russia, such as gas – but would this be a reason for relief? The question whether this dependence is a key vulnerability or, on the contrary, can be easily relinquished, is in fact a question of whether the country can effortlessly replace the rather small gas imports from Russia with other sources (domestic, gas imported from elsewhere), or whether consumption can be reduced by the corresponding amount without being too burdensome for households or industrial consumers.

Given the characteristics of various energy supplies, such as ease of access to alternative sources and routes of supply, possibility to substitute, or means to reduce consumption, countries like Romania are more concerned about gas imports from Russia than oil or coal imports. This is despite the fact that there may be higher quantities of oil or coal that require alternative suppliers to Russia than in the case of gas. This is because both coal and oil can be purchased from international markets; they depend less on “natural monopoly” network infrastructure and there is a global market for such supplies. While access poses less of a problem, prices for alternative supplies to Russia are likely to be higher than before 2020. Yet, this is a price well worth paying. The global energy market came under pressure in 2021 following the post-pandemic economic recovery and ensuing gap between energy supply and demand. To make matters worse, the Russian invasion of Ukraine and its inconceivable global repercussions create significant volatility. Romania does not rely on any other energy-related imports from Russia, e. g., nuclear technology or fuel. Considering the alternative supplies of various energy sources, Romania’s most exposed subsectors of energy are gas and, as a direct consequence of the pressures on the gas markets, electricity. Here, the country may not only be able to relinquish its own dependence on Russia, but could also support its neighbours.

Has Romania’s Energy Sector Become More Vulnerable in Recent Years?

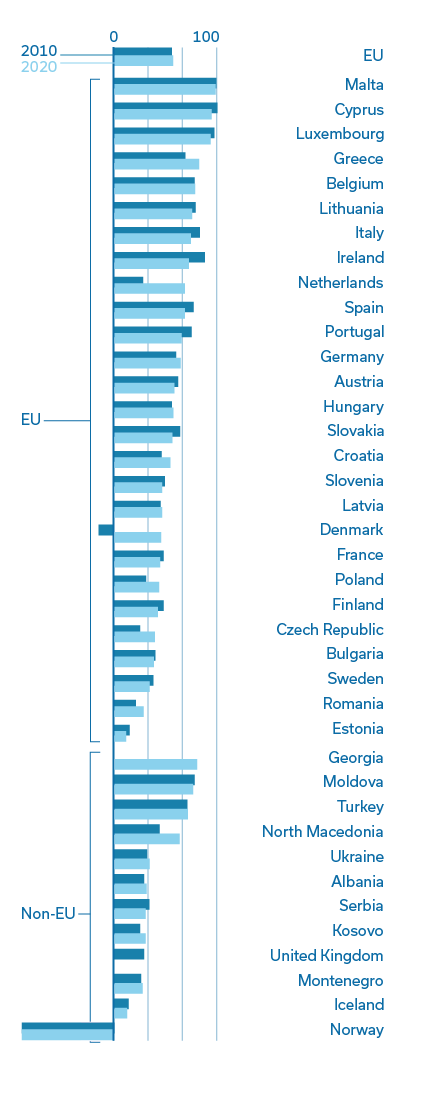

As explained above, while Romania’s energy dependence in general, and on Russian supplies in particular, is lower than in other EU member states, the trends are also important. It should be noted that the country’s dependence on energy imports has slightly increased over the past decade (see fig. 1). Overall, this is caused by a combination of non-renewable sources gradually becoming depleted, before and after 1989, and the slow pace of investments in electricity generation and grids, as well as in developing new gas deposits.

Fig. 1: Energy Imports Dependency 2010 and 2020 (in Per Cent)

Energy dependency rate for all products, 2010 and 2020 (per cent of net imports in gross available energy, based on terajoules). Norway’s value in 2010 was -512.8 and in 2020 it was -623.1 per cent. Bars are cropped for clarity. Data are not fully available for Georgia and the United Kingdom. Source: Eurostat 2022: Energy imports dependency, 2010 and 2020 (%), 1 Feb 2022, in: https://bit.ly/3uBpARk [13 Apr 2022].

Gas

Romania is a relatively small gas consumer and its annual total consumption is typically around nine to ten billion cubic metres. Gas is mainly used by households for heating, for electricity generation, and for petrochemical and fertiliser industries, with the latter undergoing rapid decline following the gas market liberalisation from 2013 to 2017. Although the country remains the EU’s second-largest producer of gas, approaching self-sufficiency for several years and only relying on gas imports for a small share of its consumption, imported gas has recently been on the increase. According to the energy regulator’s data, in 2015 Romania imported less than 2 per cent, whereas in 2019 the share of gas imports from Russia had risen to over 25 per cent. In light of recent trends, imports could be as high as 50 per cent in 2030 if no new deposits, such as those from the Black Sea, enter the market. Production declined by 20 per cent between 2017 and 2020, albeit unevenly between the two largest players (state-owned Romgaz and private OMV Petrom). Recently, Romgaz managed to slightly increase its production with the discovery, a few years ago, of quite a large onshore deposit at Caragele (30 billion cubic metres), whereas Petrom’s production declined quite rapidly, and in 2019 the company considered closing or divesting more than half of its wells over the next three to four years. The company also announced a reduction in production of seven per cent in 2022. Thus, the current increased import dependency results from a combination of declining resources, the gradual depletion of deposits currently in operation, which are 40 to 60 years old on average, poor domestic policies, a taxation regime detrimental to new investments both onshore and offshore, and the temporary return to regulated gas markets in 2018.

Despite the reduction of gas deposits currently in operation, Romania has several untapped resources: the Black Sea deposits and access to gas from the region, such as from the Southern Corridor, or from Mediterranean LNG ports in the next few years. This will be the case once the gas grids of other countries in the region, mainly Bulgaria, are further strengthened. There are two main projects in the Black Sea. The first, and closer to realisation, is a smaller deposit of ten billion cubic metres, operated by Black Sea Oil & Gas (BSOG). As the necessary legislation has been voted in May, it can become operational in the second quarter of 2022, if the gas transport operator, Transgaz, finalises its last remaining minor works for connecting the deposit to the grid. The deposit could cover some ten per cent of Romania’s consumption for a few years. The second project is Neptun Deep, estimated since the early 2010s at 42 to 84 billion cubic metres (the exact figures are not yet public). Neptun Deep is a far more complex project, requiring technologies adequate for deep offshore extraction. The two current project developers – OMV Petrom and Romgaz – have no experience in this field, unlike the original investor Exxon. The companies have not yet made the final investment decision and it would take about three years of work to bring the gas to the market. None of the two projects – that operated by BSOG or the one operated by OMV Petrom / Romgaz – is likely to become operational unless current legislation, which is quite prohibitive, is amended to reduce taxation. Investors are reluctant to take the final step, given the ad hoc legislation affecting investments adopted over the past years, such as the “windfall tax” (a tax on revenues above a threshold price with little deductions for investments). In late 2018, Romania returned to a regulated market for households for two years, and discussions are currently being held on new legislation that would effectively regulate part of the gas production, too.

BSOG took a chance and invested 600 million euros in its smaller deposit; however, it did so on the assumption that, should it incur losses due to Romanian legislation, the investment could be recovered in international arbitration. OMV Petrom and its partner (initially Exxon, currently Romgaz) anticipate investments in Neptun Deep to be as high as 16 billion euros – a much riskier venture, and the investment decision has been postponed for years. The two projects could now be further delayed if, for example, Russia’s invasion of Ukraine were to have a long-term impact on the safety of passage in the Black Sea.

Apart from offshore developments, the onshore gas extraction from deposits currently in operation could be enhanced if taxation of the gas sector were to be carefully revisited. The windfall tax of 2013 had insufficient deductions for investments and extracting the extra cubic metre from a depleted deposit requires advanced and expensive technologies. What is more, given the state of the existing production, this may only be an option for limited quantities and over a short time.

Access to gas imports from other sources depends on the acceleration of interconnections within the region. Of critical importance for the next months is the finalisation of the Bulgaria-Greece interconnector which could bring Azeri gas from the Southern Corridor to Romania. Both the European Commission and Romanian decision-makers are now pushing to accelerate the project, which stalled over the previous two years. Romania should also work to gain full access to the former Trans-Balkan Pipeline (in Romania, the Isaccea-Negru Vodă section). Although the pipeline belongs to Transgaz, the transit route is virtually disconnected from the rest of the grid and the Romanian authorities have made little effort to effectively access it for gas flows in both directions to Moldova, Ukraine, or Bulgaria. As the pipeline is fully unused by Gazprom since the finalisation of Turk Stream, Romanian decision- makers may now have more political will to fully apply EU rules on non-discriminatory access, which was not previously the case.

Demand-side measures, such as energy efficiency to reduce the dependency on gas imports, are also needed. While households and smaller non-households (companies or public institutions) have been somewhat protected from price increases during winter, high energy prices since the autumn of 2021 have primarily caused brutal adjustments to industrial consumption, particularly for the fertiliser and petrochemical industry. The government must analyse the impact of high energy prices on such industries, the extent to which these industries may be affected, and whether this may cause further significant damage to the economy. As the international fertiliser market is likely to experience a brutal crunch in the aftermath of the war in Ukraine, the government should carefully assess which is the lesser evil: less fertiliser or less gas available for the rest of the economy?

However, a relatively quick win in reducing gas demand may be the reduction of household consumption without significantly compromising quality of living. The policy should focus on thermally insulating as many buildings as possible in the next one to two years, in lieu of devising additional means to keep the utility bills under control – as currently envisaged. While the national buildings renovation strategy, approved in 2020, suggests that some 13 billion euros from the EU, public budgets, and private funding would be needed for renovation by 2030, implementation has stalled. As a matter of urgency, investment priorities in the strategy now need to be frontloaded to the greatest extent possible. The EU funds are substantial, with two to three billion euros being available rather quickly from the National Recovery and Resilience Plan (NRRP, 2.2 billion euros) and the ongoing Regional Operational Programme 2014 to 2020, where absorption for renovating multi-family apartment buildings has been slow. Additional money – probably around one billion euros – would be available from the next cycle of Operational Programmes (OP, 2021 to 2027), currently under preparation.

At the same time, the government may wish to reconsider its plans to expand gas grids to new consumers. Currently, about 50 per cent of the population live in rural areas and have no access to gas. Over the past two to three years, the government has therefore been contemplating the expansion of grids to connect new users, but without explicitly coupling this measure with energy efficiency – thermal insulation of the houses to be connected. This approach should now be reconsidered, particularly since there is little evidence that gas prices will be affordable for relatively poorer rural households in years to come. Even though the plan is to make these grids and new users “hydrogen-compatible” as well, this is unrealistic. Romania has no hydrogen strategy and little idea about potential and technologies for producing significant hydrogen quantities, while the NRRP includes the preparation of such a strategy.

Until the hydrogen potential is realistically assessed, it is highly likely that new gas connections would be built and would become stranded assets shortly thereafter; or that increased gas consumption would expose the country to imports to an even greater extent, without the prospects of subsequently replacing methane with hydrogen. Thus, initiatives in the current Large Infrastructure Operational Programme 2014 to 2021, where some 250 million euros have been reallocated for expanding the gas grids to new consumers – and which does not even consider hydrogen – should be abandoned. The NRRP also includes a 515-million-euro component to expand gas networks to a specific region in Romania (Oltenia). The plan in the NRRP is to introduce 20 per cent hydrogen in this new regional grid by 2026 and 100 per cent by 2030. However, the approach is unrealistic, e. g., it would be difficult to switch the end consumers, initially connected to an 80 per cent methane energy source by 2026, to 100 per cent hydrogen four years later; the two types of fuel require completely different equipment, house appliances, and safety measures in households. There is therefore a high risk that, if the grids were built, consumption would remain path-dependent at 80 per cent methane well beyond 2030.

Electricity generation is another large consumer of gas, and this is likely to increase if current plans are executed. Overall, gas features prominently in the National Energy and Climate Plan (NECP) as a transition fuel for electricity generation – with a total of about 2.8 gigawatts of new gas-fired capacity planned by 2030. To develop these capacities, EU funds and mechanisms would be used. Romania has an estimated 16 billion euros in the Modernisation Fund, several billion euros of which could be used for the coal-to-gas transition (e. g. the restructuring of the power plant CE Oltenia, currently lignite-fired power capacities, but also investments in cogeneration for district heating in a few larger cities) or for the installation of new gas-fired plants to offset expected intermittent renewables that are to be installed by 2030 (renewable energy sources of about six gigawatts). An additional 300 million euros is envisaged in the NRRP for gas-fired cogeneration plants to co-finance the installation of 300 megawatts. All these plans must be carefully reassessed in line with the upcoming change of EU energy policy and new energy security realities. Over the next weeks and months, it is likely that the European Commission will massively restructure its energy policy and will require a significant readjustment of national plans, i.e., revisions of NECPs and NRRPs, as well as reprioritisation of how available EU funding is allocated, towards more renewables and storage, as well as gas route and source diversification.

Finally, after solving its own dependence on Russian gas with increased domestic production, Romania can seriously loosen the Russian monopoly’s grip on the region. All countries in the region, now fully reliant on Russian gas, are relatively small gas consumers: Bulgaria at three, Moldova (without Transnistria) one, and even Hungary at just ten billion cubic metres, similar to Romania.

Electricity

Romania’s electricity sector is much more vulnerable in terms of energy security than it seems at first glance. For years, Romania has boasted large installed electrical capacities: as recently as 2019, the energy regulator theoretically counted almost 22 gigawatts, more than twice the capacity needed for peak consumption of 9 to 10 gigawatts. Although it seems reassuring, much of the capacity merely exists “on paper”; i.e., it is simply neither operational nor operationalisable in the future. Instead, statistics on the electricity system’s actual operation demonstrate that Romania has become a net importer of electricity since 2019, and is likely to remain so in the medium term if no significant investments are made in years to come.

The stock of non-operational electrical capacity, as well as rapidly shrinking oil and gas deposits, where production has declined by about 20 per cent over the past four years, indicate that the Romanian energy sector is in fact rather vulnerable. This is particularly the case if we consider the world after February 24. To understand the real state of the country’s energy security, we must correctly appreciate how the current energy capacities developed.

Prior to 1989, the country’s chaotic development of the energy sector, following an equally irrational industrial overdevelopment, took place in two phases. The first phase entailed massive, accelerated development of oil and gas extraction, processing, and use, including for electricity generation, which led to a decline in oil and gas reserves. The second phase started from 1965 to 1970 onwards, as limits of the oil and gas production became apparent and owing to the 1973 international oil crisis. The regime shifted towards heavy investments in coal for cogeneration units, as well as hydro, and initiated massive plans for nuclear energy (the two 700 megawatts reactors at Cernavodă, which finally became operational in 1997 and 2007, represent just ten per cent of the original plan). While large gas-fired electricity generation became effectively stranded assets, the poor and deteriorating quality of coal (lignite) led to only about 45 per cent of coal-fired electricity generation having been operational in 1989. All these assets appear on the stock count of existing capacities and lulled Romanian authorities into a false sense of security for years.

Following 1989, significant and widespread changes in the economy and people’s lifestyle altered the patterns of Romanian energy production, consumption, and imports. Household consumption increased from the almost negligible baseline of 1989, energy-intensive industries were significantly restructured during the 1990s and downsized once again after the economic crisis of 2009 to 2011. What is more, the overall infrastructure, built around large power generators and high industrial consumption, could not keep apace with the shift in territorial distribution of demand. Investments in generation consisted of two nuclear units (1,400 megawatts) by 2007; some gas-fired power plants, of which the largest is Petrom Brazi (860 megawatts); and wind and solar energy from 2010 to 2013 (about 4,500 megawatts, but with intermittent generation). Compared to 1989, by the early 2030s Romania will need to install nine gigawatts of new capacities to replace the oversized, obsolete, or simply non-functional coal- and gas-fired units. Thus, investments in new technologies and networks are critical. The closure of fossilfired power plants that do not comply with environmental standards, are obsolete, or economically inefficient, coupled with the absence of new investments, is the main reason why Romania recently became a net importer.

In recent years, investments in the electricity sector have stalled: virtually no new capacity was installed after 2016. While from 2011 to 2013 Romania’s regulatory environment was highly advantageous for solar and wind, support schemes were consecutively slashed in the following years bringing new investments to a halt; at the same time, frequent changes in legislation and regulations engendered operational difficulties or uncertainties for the units already installed. Administrative barriers – such as restrictions for power purchase agreements or authorisations to grid connections – meant that investments in the sector also faced unsurmountable barriers. This is despite the fact that significant new capacities could have been installed after 2017 in pure market conditions, without the need for state aid or any kind of additional support mechanisms. As regards connection to the network, examining the consecutive ten-year network development plans of the transport operator, Transelectrica, since 2016, we see that the company registers delays in over 80 per cent of network modernisation projects and in all projects specifically targeted at integrating renewable energy sources. These delays, also not promptly sanctioned by the energy regulator ANRE, cannot be explained by a lack of available funds, as the company incurred delays even for projects from EU funds, such as network strengthening in the Large Infrastructure Operational Programme or the interconnections with neighbouring countries financed directly from Brussels as Projects of Common Interest (PCIs).

The priorities for investments in future years have largely been captured in the latest version of Romania’s NECP. However, as highlighted in the Gas section above, some of these priorities may have to be substantially reconsidered. This would entail moving away from gas and shifting the focus to renewables and storage. Currently, there would be significant scope for private sector investments with a planned regulatory support (a “contract-for-difference” operational support committed to in the NRRP) plus several state aid schemes directly using EU ETS (Emissions Trading System) funds (the Modernisation Fund) and EU funds (NRRP, Sustainable Development Operational Programme 2021 to 2027, currently under development). For example, the NRRP alone includes 460 million euros of direct investment for an additional 950 megawatts by 2026, plus 440 million euros for electricity storage and recycling of renewable equipment. Transelectrica and distribution operators must also greatly accelerate the development of transport and distribution grids in order to facilitate flexibility (smart metering, smart grids, up-to-date SCADA systems (supervisory control and data acquisition), and other digitalisation investments). Several projects for network strengthening would be financed through the Modernisation Fund – 23 million euros were approved in late 2021 to better integrate the renewables from the Dobrogea area into the national system.

As the intermittence of renewables would pose significant challenges for managing the energy system, some of the financial support would need to be targeted at electricity storage, both for the grids and attached to the renewable capacities. Additionally, Romania intends to develop offshore wind in the Black Sea (and there is already private interest in such an investment). It would require careful planning for Transelectrica’s network development – offshore wind is located close to the area of the transport network that is the most congested.

Finally, speeding up investments in the Romanian electricity sector, particularly in renewables, may further limit dependence on Russia in the region; additional renewable production can at least partially displace gas-fired generation in Hungary (28 per cent of the country’s electricity mix in 2021) or Moldova (virtually all generation).

The Way Forward

While investments have stalled in recent years, due to the country’s poor strategic planning, ad hoc legislation and regulations, tectonic changes underpinning the European energy policy in 2022 require a significant build-up of capacity and political will. The first priority is likely to be a massive upgrade of the administrative capacity in all key positions in the Ministry of Energy, the energy regulator ANRE, and state-owned companies (gas and electricity producers, Transelectrica, Transgaz, etc.). This requires an honest assessment of the current appointees in terms of competence and integrity.

Funding is available, substantially from EU grants and the private sector, to virtually all projects in gas production, electricity generation, as well as network and infrastructure strengthening. This is, provided that there is a clear commitment to the real modernisation of the sector, to build resilience and limit the damage of Romania’s current energy dependence on Russian supplies, particularly gas. Romanian decision-makers need to be fully willing and able to work with their counterparts in other EU member states and in Brussels to prepare the new EU energy policy, follow-up with implementation, and contribute towards joint efforts for the EU’s energy security. Significant efforts are needed to: make an honest appraisal of the existing energy infrastructure and its state; build emergency and energy security plans for the short and medium term; revise the NECP and possibly NRRP in line with upcoming changes from Brussels; and create a favourable investment environment for domestic gas production, renewables, storage and energy efficiency in industry and households. Not only will this contribute to Romania’s own energy security, it will also help all its neighbours shake off the dependence on Russian gas supplies or gas-dependent electricity.

Otilia Nutu is a Policy Analyst on energy and infrastructure at Expert Forum Romania and Co-Chair of the Eastern Partnership Civil Society Forum.

Choose PDF format for the full version of this article including references.