Issue: 2/2022

Russia’s war of aggression on Ukraine has not only called into question old certainties of German and European foreign and security policy. It also presents a challenge to Europe with regard to its energy supply: as long as the politically motivated full-scale phase-out of Russian oil and gas exports to the EU has not been completed, Europe’s economy and households remain dependent on these supplies. In tandem, the payments for them help the Kremlin to finance its war. Moscow’s strong position in the European energy market also puts pressure on Europe, as shown by the energy embargoes imposed, for instance, on Bulgaria and Poland. Despite this, Germany and its European neighbours seem determined to reduce, or even end, their dependence on Russia – currently the world’s second-largest oil exporter and leading supplier of natural gas. In March 2022, the EU announced that it would cut imports of Russian gas by two-thirds by the end of the year, and would cease imports of Russian gas and oil by 2027. The German government followed suit, declaring that it planned to halt Russian oil and coal imports by the end of 2022, and completely withdraw from Russian gas by mid-2024. Simultaneously, the Sword of Damocles of climate change hangs over Germany and Europe, both of which have made a firm commitment to move away from fossil fuels, and towards decarbonisation and renewables. Against the backdrop of the Ukraine war, even Robert Habeck, Germany’s Green Federal Minister for Economic Affairs and Climate Action, has had to concede that, “when in doubt”, ensuring energy supply security takes priority over climate action.

The current debate revolves around the potential of alternative oil and gas supplier countries to replace Russia’s exports to Europe. However, it is important to examine which factors could constrain this, such as existing transportation options, regional dynamics, and changes in energy policy. It is also necessary to consider long-term perspectives with a view to a sustainable transition of the European energy supply to renewable energies. We will now look at this complex situation as relates to the MENA region, and particularly the Arab Gulf states.

Europe’s and Germany’s Dependence on Energy Imports

Germany, and large swathes of Europe, are dependent on energy imports to meet their industrial and household needs, to generate electricity, and for countless other applications. The dependency rate – the extent to which an economy relies on energy imports to meet its own needs – averaged 61 per cent across Europe in 2020. According to the EU Commission, 20 member states were dependent on Russian energy imports. In 2020, a quarter of the EU’s crude oil imports came from Russia, while almost half of Russia’s exports of crude oil and oil products went to Europe. Concerning gas, the EU imports 90 per cent of its consumption, with Russia supplying nearly half of this volume before the war began. Russia also accounted for more than 50 per cent of solid fuel sources, such as coal. Germany, as Europe’s biggest economy, is also heavily dependent on Russian energy. Until recently, Russia accounted for 55 per cent of gas imports, 50 per cent of coal, and 35 per cent of crude oil in Germany’s energy mix. In 2021, Russian oil and gas exports to Germany were worth 19.4 billion euros. Germany quickly began reducing these volumes in the weeks after the war began, and by the end of April 2022, Russian oil made up just 12 per cent, and Russian gas 35 per cent of German imports. Nevertheless, warning voices are still being raised – particularly from the ranks of German industry – about the risk posed to jobs and order books of a precipitate and total halt to energy imports from Russia.

Fig. 1: Fossil Fuel Reserves and Liquefied Natural Gas Exports of Selected Countries of Europe’s Southern and South-Eastern Neighbourhood 2020

Source: own illustration based on BP 2021: Statistical Review of World Energy 2021, pp. 16, 34, 44, in: https://www.bp.com/en/global/corporate/energy-economics.html [9 May 2022].

The pressure to look for alternative energy suppliers has led to something of a parade of European politicians visiting neighbouring regions. On behalf of the EU, Energy Commissioner Kadri Simson has been busy touring the Gulf region and visiting Egypt, Algeria, and Azerbaijan. These destinations are hardly surprising. Firstly, Europe’s largest oil and gas suppliers after Russia – Norway, the UK, and the Netherlands – have declared that their ability to increase capacity is limited. Secondly, it makes sense to focus on the countries in Europe’s south-eastern and southern neighbourhood – from North Africa to the Arabian Gulf, with their rich oil and gas reserves. However, it is important to assess the potentials and limitations of alternative energy imports to Europe.

Fig. 2: Gas Pipelines from North Africa to Europe

Source: own illustration based on Holleis, Jennifer / Schwikowski, Martina 2022: Erdgas für Europa: Afrika rückt nach, Deutsche Welle, 3 Mar 2022, in: https://p.dw.com/p/47yVi [10 May 2022].

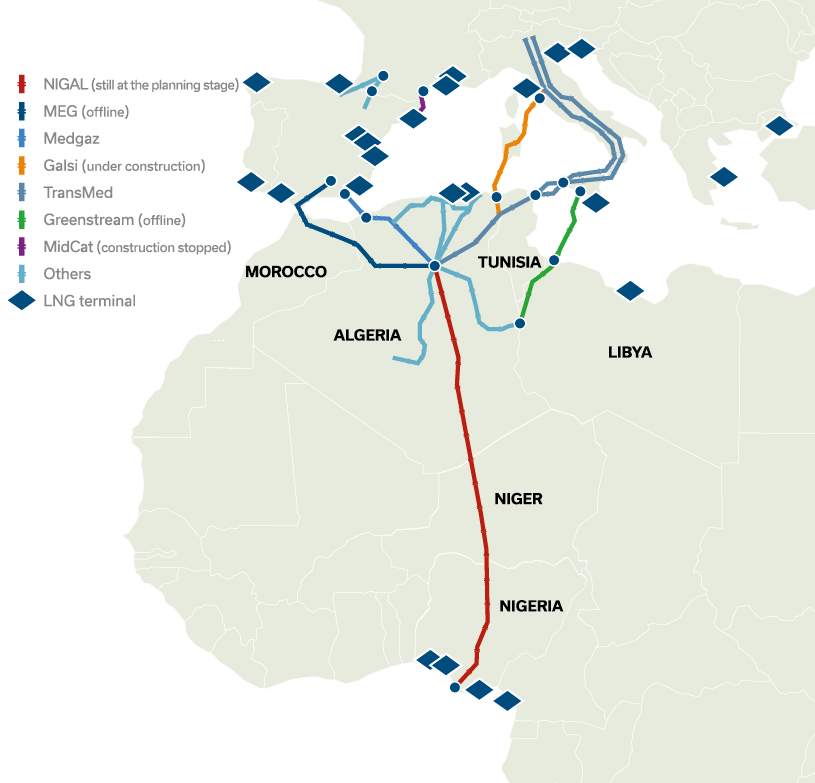

North Africa and the Eastern Mediterranean: Partners with Ifs and Buts

Europe’s fossil fuel trade relations with North African countries, such as Morocco, Algeria, Libya, and Egypt are well-established and reasonably resilient. There have been direct pipeline connections for decades. Medgaz transports Algerian gas directly to Spain, or it reaches southern Europe via two transit countries – Tunisia (TransMed) and Morocco (Maghreb-Europe Pipeline, MEP) – which in turn purchase Algerian gas as well. In a subregional comparison, Algeria has the largest natural gas reserves, at 2.3 trillion cubic metres. However, the availability of Algerian gas for export to Europe is constrained by the ageing pipeline infrastructure and the vulnerability to political crises. For instance, the MEP, which has existed since 1996, ceased operations in 2021 due to bilateral tensions between Algeria and Morocco. Algiers decided not to renew the supply contract in a (so far unsuccessful) attempt to force Rabat to make concessions in the Western Sahara conflict, which has divided the two neighbours for decades. The Iberian Peninsula’s dependence on Algerian gas meant it had to adapt to the new situation. Moreover, for historical reasons, Algeria maintains close political ties to Moscow, including arms supply and energy relations – for example, Gazprom has a stake in certain Algerian gas fields. This makes Algeria not an unreliable, but still ambigious partner.

Fig. 3: Gas Deposits in the Eastern Mediterranean and in the Disputed Exclusive Economic Zone of Cyprus

Source: own illustration based on Weisflog, Christian 2019: “Global Risk”: Ägypten ist ein Energieriese auf tönernen Füssen, Neue Zürcher Zeitung, 5 Sep 2019, in: https://nzz.ch/-ld.1506234 [26 Apr 2022].

Libya has large oil and gas reserves (6.3 billion tonnes of crude oil; 1.4 trillion cubic metres of natural gas). In 2020, 4.2 billion cubic metres of Libyan gas reached Europe, primarily in the form of liquefied natural gas. Liquefied natural gas (LNG) is produced by cooling natural gas so that it liquefies and can be transported independently of the existing pipeline infrastructure, for example by ship. Oil and gas exports to neighbouring Europe are expected to increase when extraction and production at the huge Tahara-Hamada field in the west of the country is ramped up this year and investment flows into the Greenstream gas pipeline, which is currently only running at low capacity. However, production and exports will remain limited for the foreseeable future due to the infrastructure damage inflicted since the civil war began in 2011, and the unresolved political conflict between the western and the divided oil-rich eastern part of the country, which has also received Russian support.

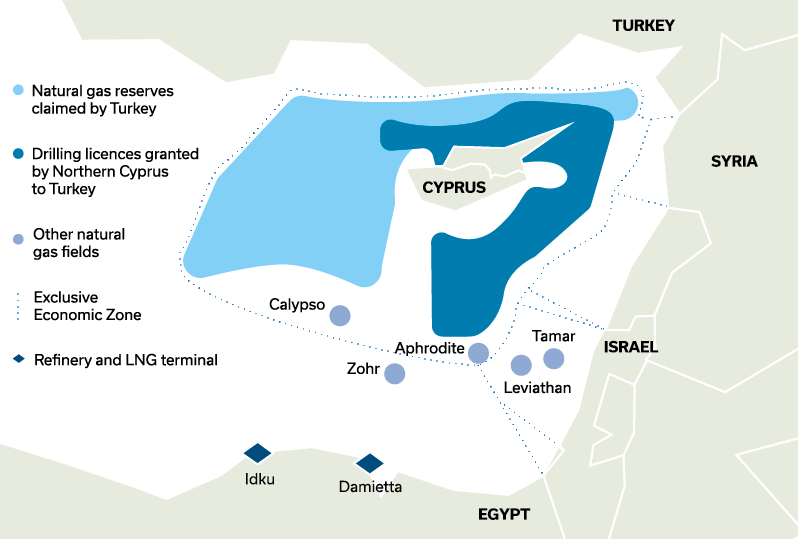

In the eastern Mediterranean, Egypt and Israel have become important players on the energy front in recent years, and are potential exporters of fossil fuels to Europe. However, there are currently no direct pipeline connections between this region and Europe. Egypt has increased its natural gas reserves to 2.1 trillion cubic metres by developing the Zohr offshore gas field – at 850 billion cubic metres possibly the largest reservoir in the Mediterranean. Meanwhile, Israel has reserves of around 600 billion cubic metres in the Leviathan field. To date, Israel has focused on producing gas to meet its own needs, and to use it as a commodity and political tool for stabilising relations with neighbouring countries, such as Egypt and Jordan. However, Egypt’s reserves certainly have the potential to be exported to Europe. In 2021, Egypt supplied Europe with some two billion cubic metres of gas through its two LNG terminals, Idku and Damietta. Around 15 per cent of Egypt’s gas exports went to European LNG terminals in 2021. Experts believe that Cairo could increase these figures within three years and compensate for around 200 billion cubic metres of Russian gas. However, this would mean ramping up capacity at Idku and Damietta, and Europe would also have to increase its capacity to import and inject liquefied gas. Egypt also has to meet the energy needs of its own large population, which limits its potential as an exporter.

Another obstacle to any expansion plan is the continuing high cost of gas exploration in the eastern Mediterranean, including requisite liquefaction and shipping. In view of this, the exact conditions under which Egyptian gas can be sold at competitive prices remain unclear. There are, moreover, ongoing disputes between Mediterranean coastal states over the distribution of Exclusive Economic Zones. In 2019, Egypt, Israel, Cyprus, and Greece founded the East Mediterranean Gas Forum, an intergovernmental organisation, with the aim of developing a regional gas market with correspondingly competitive gas prices. Its members include Italy, France, and others, but exclude Turkey. A key element of this is the construction of the EastMed pipeline. Almost 2,000 kilometres in length, it is projected to run from the gas fields in the eastern Mediterranean, along the southern Cypriot coast to Crete, and its capacity of up to 20 billion cubic metres should boost Europe’s energy supply. However, no final decision has yet been made on the construction of the pipeline due to considerable scepticism in some quarters regarding its financial and technical viability. As a result, experts suspect that “gas from the eastern Mediterranean […] is unlikely to enable states to supply significant volumes of gas to Europe. So, it is likely that the energy sources will primarily be exploited to supply domestic markets.”

Fig. 4: EastMed Gas Pipeline, Bypassing Turkey

Source: own illustration based on Weisflog, Christian 2019: “Global Risk”: Ägypten ist ein Energieriese auf tönernen Füssen, Neue Zürcher Zeitung, 5 Sep 2019, in: https://nzz.ch/-ld.1506234 [26 Apr 2022].

Turkey’s exclusion from the East Mediterranean Gas Forum has led Ankara to adopt an aggressive stance towards its neighbours over recent years. So far, this has only abated slightly in the area of regional energy policy. Turkey also believes it has a right to conduct exploration missions within what it perceives as its own waters, in violation of international rules. Due to this policy – which even includes a military element – Ankara has isolated itself and lost a great deal of trust among its neighbours. Furthermore, the unresolved Cyprus conflict, or more specifically the exclusion of the Turkish Republic of Northern Cyprus (which is only recognised by Turkey) from any share of energy profits, prevents any significant progress in regional energy cooperation, especially with regard to pipeline construction, which would have to include Turkey and Cyprus in order to be economically and environmentally feasible, as well as politically viable.

Since the end of 2021, Turkey has presented itself as a conciliatory regional player with close ties to Europe, and as a diplomatic mediator in the war between Russia and Ukraine. However, when it comes to energy policy, Ankara remains a complex and difficult partner for Europe. Turkey is also heavily dependent on Russia for its energy supply and – through its pipeline deal with Russia – contributed to the weakening of Ukraine, as well as to the Balkans’ dependence on Russia. Nevertheless, Turkey can still be a transit country for alternative methods of transporting fossil fuels to Europe. Azerbaijani crude oil is conveyed across Georgia to the Turkish Mediterranean coast via the Baku-Tbilisi-Ceylan (BTC) pipeline, which runs through eastern Anatolia and has been in operation since 1998. Recent gas discoveries on the Black Sea coast have reduced Turkey’s reliance on Russia and, above all, since 2018, Azerbaijani natural gas has also been reaching Greece and Italy via the Trans-Anatolian Pipeline (TANAP), passing through Georgia and Turkey. It currently transports 16 billion cubic metres of gas, but this volume is set to double by 2026. If Turkey were also to succeed in integrating more oil and gas from Iraq or even Iran (if Western sanctions against the regime in Tehran were to be removed) into its transport system, the country could present itself as a key supplier of fossil fuels to Europe – a factor that is likely to play an increasingly important role in both Turkey’s application to join the European Union and in terms of President Erdoğan’s political power.

New Needs, Old Friends: The Gulf States

In its search for new suppliers of oil and gas, Europe’s attention has also turned to the major energy producers and its long-standing partners in the Gulf. Saudi Arabia could provide an alternative to oil imports from Russia. The kingdom possesses about 17 per cent of the world’s proven oil reserves and is the world’s largest exporter of crude oil. It currently has spare capacity of about 180 thousand tonnes per day, while the United Arab Emirates (UAE) has around 160 thousand tonnes per day. According to experts, these two nations could prevent the expected oil shortage on world markets and bring prices down. However, the growing politicisation of energy markets complicates the situation. The war in Ukraine has caused oil prices to rise to over 100 US dollars per barrel, the highest level since 2014. Revenues from oil and gas make up around 40 per cent of Russia’s federal budget. Since the war began, the US and EU have tried to encourage Saudi Arabia, the UAE and Qatar to ramp up production, thereby lowering world prices and reducing Europe’s dependence on Russian imports. The Organisation of the Petroleum Exporting Countries (OPEC), led by Saudi Arabia, initially refused to substantially increase oil production, and held firm to the production plan agreed with Russia within the framework of the OPEC+ group. However, in early June 2022, the intergovernmental body gave in to pressure from the US and its allies, stating it would raise its additional oil production. Riad announced it would compensate for a potential drop in Russia’s output if sanctions imposed on Moscow were to cause shortages on global markets.

The backdrop to this partnership, and to the Gulf states’ reluctance to adopt a clear stance against Russia, is multifaceted and based on a variety of economic and foreign policy motives.

For the Gulf monarchies, Russia is also an important dialogue partner with regard to natural gas, namely in the Gas Exporting Countries Forum (GECF). Alternative suppliers of gas are limited, and, like crude oil, it cannot be transported from the Gulf region to Europe by pipeline, but only by sea in the form of liquefied natural gas. With its huge gas reserves, Qatar is the world’s largest LNG supplier. Doha recently declared its willingness to contribute to European energy security by making additional shipments, but stressed that it was not in a position to provide unilateral support. Qatar would be able to divert 10 to 15 per cent of its gas shipments, but this would not be enough to replace Russian gas in the short term. By 2027, Qatar plans to increase its annual LNG capacity from 106 to 174 billion cubic metres. However, most of Qatar’s LNG is tied up in long-term supply contracts, primarily with Asian countries, such as China and Japan. Moreover, many European countries, especially Germany, lack a sufficiently developed LNG infrastructure (particularly storage and regasification facilities, where the imported LNG would be fed into the European or German energy grid). The German government has already announced that two stationary LNG terminals will be built in Wilhelmshaven and Brunsbüttel by 2025. In addition, three floating LNG facilities are currently being planned across Germany; the first mobile LNG terminal could come onstream by the end of 2022. This would allow around nine billion cubic metres of gas to be procured – almost 20 per cent of the gas volume currently purchased from Russia. However, questions relating to the cost of creating new infrastructure for the more expensive LNG, alongside the environmental cost of shipping LNG around the world, remain unanswered.

Germany’s Minister for Economic Affairs, Robert Habeck, visited Qatar and the UAE in March 2022 for talks on the future of Germany’s energy supply. In Doha, Germany and Qatar agreed on a long-term energy partnership for LNG supplies. But at present this represents little more than a strategic roadmap. Just a few weeks before the Zeitenwende triggered by the Russian invasion, Germany’s Greens in particular viewed the Arab Gulf states with great scepticism. Now they have undergone a remarkable change of heart in light of the new developments, mutating from plaintiffs to supplicants. The Green narrative of a future energy policy that would exclude the controversial Gulf suppliers now seems to have collapsed.

However, this part of the world and its energy system are not free of regional instabilities. The almost regular attacks conducted by Yemen’s Houthi rebels on Aramco facilities in Saudi Arabia underline how – with a fresh focus on the Gulf for energy supplies – other disruptive factors, such as military attacks on export infrastructure, may affect supply security. Additionally, despite the current relative thawing of relations between Saudi Arabia and Iran, regional rivalries continue to present a problem that could, as in the past, impede the passage of tankers, for instance through the Strait of Hormuz. But, most importantly, while a long-term commitment by Europe to buy more oil from Saudi Arabia and the UAE, or natural gas from Qatar, would reduce dependence on Moscow, it would also create new dependencies. Europe should also keep a close eye on the Gulf states’ strategy of freeing up more fossil fuels for export by promoting renewable energy for domestic consumption. By doing this, the Gulf states are giving potential importers an additional incentive to become even more dependent.

A New Era of Renewables – Green Electricity …

In addition to the crucial role played by the Arab Gulf states in the global supply of oil and gas, the region also has the potential to become a centre of gravity in a different aspect of the energy debate. Despite the renewed focus upon fossil fuels, the political fallout from the Ukraine war will cause the climate-related energy transition to progress faster than anticipated. This is because high oil and gas prices are fuelling a rethink in the direction of alternative energies, not only in Europe and the US but also in the Gulf. As a result, the world’s fossil fuel powerhouse is also undergoing a seismic shift in its energy policy.

The Gulf region has the natural conditions for the development of renewables, along with the associated reduction in carbon emissions, as well as the financial resources required to drive the global and regional energy transition. Its financial stability will be further consolidated by the increased global demand for fossil fuels. Environmental and energy policy are important motivators in this respect, but they are joined by many other aspects, such as regional and strategic power, security, economic issues, and prosperity. In their shift away from fossil fuels, the Gulf states can also point to a wealth of experience and forward-looking promises – despite, or perhaps precisely because of, the vital role that oil and gas will continue to play in their economic and social models.

Once small, marginalised states on the Arabian Peninsula, the Gulf monarchies rose to become rich and powerful petrostates in the second half of the 20th century. The faster the importance of “black gold” gives way to that of green electricity, the more pressure is exerted on the prosperity and regional power of the Gulf states. Their expertise in the energy sector, acquired or imported during their history as major global energy suppliers, is indispensable for preserving their own prosperity but also for their transition to a post-carbon economy. Over the last few years, they have begun preparing for the upcoming post-oil era and have positioned themselves to take on the role of regional and global leaders in the energy transition. In many cases, this is motivated by the need to continue legitimising their rentier-state systems at home and stabilising political conditions in their societies, while simultaneously engaging in nation branding and improving their international reputation.

The Gulf Cooperation Council countries seem to be following a similar pattern in their approaches. In their extensive national strategic plans and “visions”, the Gulf states have set themselves ambitious targets for renewables and hydrogen as future energy sources. Saudi Arabia, for example – still the world’s largest oil exporter, with close to 90 per cent of government revenues coming from the oil sector – aims to generate half of its energy from renewable sources by 2030. Currently, the share is just 0.3 per cent, which is why experts consider the target to be at best ambitious, and at worst unrealistic. Nevertheless, it plans to pour billions of dollars into research and development of projects. The UAE, meanwhile, announced its “Net Zero 2050” strategic initiative in 2021, which aims to achieve net zero carbon emissions by 2050. Clean energy from renewable sources and nuclear power will be a key element of this strategy to reduce greenhouse gas emissions.

In recent years, alongside ramping up oil and gas production, countries like Saudi Arabia and the UAE have substantially increased the amount of electricity generated from renewable sources. Today, the UAE produces similar volumes to European countries such as Hungary and Switzerland. In light of their enormous and under-utilised solar power potential, the Gulf states have launched some of the world’s biggest solar projects, including the world’s largest solar power plant. This plant was initiated in 2012, south of Dubai, and has a targeted capacity of five gigawatts, covering an area of 77 square kilometres, and with an investment volume of 13.6 billion US dollars. The potential of solar power also goes beyond simply supplying electricity. For example, a major Saudi project, the world’s largest solar-powered seawater desalination plant in Al Khafji, uses photovoltaic power to turn saltwater into fresh water – meeting the daily needs of 100,000 people.

Not to be underestimated, naturally, is the impact, both at home and abroad, of cultivating a glossy green image. The region is attracting global attention by hosting major international “green” events, such as Expo 2020 (2021/22) in Dubai with its specific focus on the green economy and innovations relating to climate change and sustainability; the Abu Dhabi World Climate Conference (COP 28, 2023); and the 2022 World Cup in Qatar, which the organisers are promoting as a carbon-neutral event under the title “Green Qatar 2022”. This includes new ideas for making the event more sustainable, such as modular stadiums that can be rapidly disassembled. The Gulf states have also made a – mainly financial – commitment to the international fight against climate change and are forming new alliances. For example, on the fringes of the 2021 Climate Change Conference in Glasgow, the Emirates unveiled a partnership with the International Renewable Energy Agency (IRENA), based in the ecological model city of Masdar near Abu Dhabi. The aim is to develop an Energy Transition Accelerator Financing Platform as a multi-stakeholder climate finance solution to advance the energy transition in developing countries. The UAE plans to provide 400 million US dollars for this purpose, thus making a substantial contribution to raising the platform’s goal of at least 1 billion US dollars to be used to generate 1.5 gigawatts of cleanly produced and stored energy by 2030.

… and Hydrogen from the Desert

Finally, as regards the energy world of the future, Saudi Arabia and the UAE are vying to become the world’s leading exporters of hydrogen. This is primarily blue or green hydrogen, where electricity from natural gas combustion (blue) or renewable energy sources (green) can be used for electrolysis, which splits water into hydrogen and oxygen. It is produced without or with reduced carbon emissions. The hydrogen produced can either be used directly to power engines and turbines, or pass through a methanation stage to produce synthetic gas (power-to-gas) – hydrogen is expected to replace natural gas in the medium term – or it can be turned into liquid fuels (power-to-liquid). These green fuels can then be used in heat generation, the transport sector, and the steel and chemical industries. Experts believe green hydrogen will play a key role in defossilising the world’s energy economy.

The UAE has excellent conditions for the cost-effective production of hydrogen from renewable energies and is keen to begin the first hydrogen deliveries to Germany as early as 2022. The first solar-powered green hydrogen plant in the region was built in Dubai in 2021. During the day, the plant harnesses some of the electricity generated by the adjacent solar park to produce hydrogen. At night, the green hydrogen is converted into electricity to power the city with sustainable energy. Saudi Arabia is also planning the future of green hydrogen on a grand scale. NEOM, an 85-square-kilometre carbon-free “city of the future” that is being built in the north of the kingdom, will be home to the world’s largest green hydrogen plant. This electrolysis plant will integrate four gigawatts of renewable power – ten times more than Saudi Arabia’s existing solar capacity.

The Gulf states also have big plans for ammonia, which is suitable as a fuel because of its high hydrogen content. It is also easy to store and transport in liquid form. In September 2020, Saudi Aramco, the world’s largest oil company, caused a stir when it sent its first shipment of blue ammonia from Saudi Arabia to Japan. The UAE is also driving ahead with a blue ammonia production plant in Abu Dhabi and struck an ammonia cooperation deal with Japan in 2021.

Examples like these show that the Gulf states are willing to invest their fossil fuel revenues in innovation and in the regional and global energy transition. Overall, the Gulf could become a test case for the expansion of green electrification and the effect could radiate out to the whole of the MENA region – a region whose energy infrastructure is sorely in need of an overhaul in terms of modernisation and efficiency.

Diverse and Lasting Partnerships: Time for a “Polygamous” Energy Policy

As seen, the MENA region and especially the Arab Gulf states are currently viewed as a potential solution to Europe’s energy supply dilemma. Their reserves of oil and gas and established infrastructures mean they can supply the EU with a limited amount of additional fossil fuels in the short to medium term. However, Europe cannot rely solely on the countries in its southern and south-eastern neighbourhood to completely replace its energy imports from Russia. With the exception of North Africa, there are no direct pipeline connections to Europe to enable the cost-effective procurement of natural gas, and Europe’s synchronous grid still has too little capacity for LNG landfall and injection. Moreover, many other countries, especially in Asia, will also need to meet the continuing high demand for crude oil and LNG, and will thus compete with Europe to buy LNG from the Gulf states.

Furthermore, the discussion about fossil substitutes for Russian oil and gas would be too short-sighted if it did not consider how times are changing when it comes to energy. Even before Russia’s invasion of Ukraine, Europe was making a shift towards alternative energy sources. This trend has been given strong impetus now that Europe’s energy dependencies have become painfully obvious. In addition to the European Green Deal of 2019, in spring 2022 the EU Commission proposed an outline for a new energy plan. In conjunction with the announced exit from oil and gas trade with Russia, the new plan aims to increase the resilience of the EU-wide energy system and meet climate targets. For example, oil and gas supplies will be diversified by expanding pipeline connections to non-Russian suppliers and increasing imports of LNG. Additionally, the aims are to achieve swifter reductions in the use of fossil fuels, expand renewables, and improve supply security by increasing the production and import of biomethane and green hydrogen. In this context, too, the countries of the Middle East, and particularly the Arab Gulf states, could be promising – albeit critically scrutinised – partners and key players in an increasingly decarbonised global economy.

If Germany and Europe are to permanently free themselves of their dependence on Moscow, they will have to adjust their policies towards the Gulf states, and build long-term partnerships with their Arab neighbours, by investing in the development of a joint infrastructure, not only for producing and trading in oil and gas, but also for solar and wind power, and green hydrogen. Ultimately, it is essential to ensure the German and European energy mix is as broad as possible, and to keep the number of energy sources and suppliers as large as possible in order to avoid major dependencies – on petro- and electrostates alike. At the same time, Europe and Germany can and should approach MENA energy producers and suppliers not as supplicants, but as partners. Energy innovation partnerships will help countries to manage their transition to renewable energy, more energy efficiency, a green economy, and the dawn of a hydrogen-fuelled future. Europe and Germany can offer the expertise and reliability that will also find favour in this region.

– translated from German –

Simon Engelkes and Ludwig Schulz are Desk Officers in the Middle East and North Africa Department at the Konrad-Adenauer-Stiftung.

Choose PDF format for the full version of this article including references.